MFS® 529 Savings Plan

-

Overview

Overview

The MFS 529 Savings Plan was designed to offer a wide range of investment choices, gifting and estate tax benefits, as well as quality service. And, of course, the investment management expertise of MFS Investment Management.

-

Investment Options & Pricing

Investment Options & Pricing

-

Investment Options

-

Underlying Fund Allocations

-

CUSIP/Ticker Summary

-

Plan Pricing

Investment Options

Investment Options

An MFS 529 Savings Plan offers a variety of investment choices, as well as two investment paths.

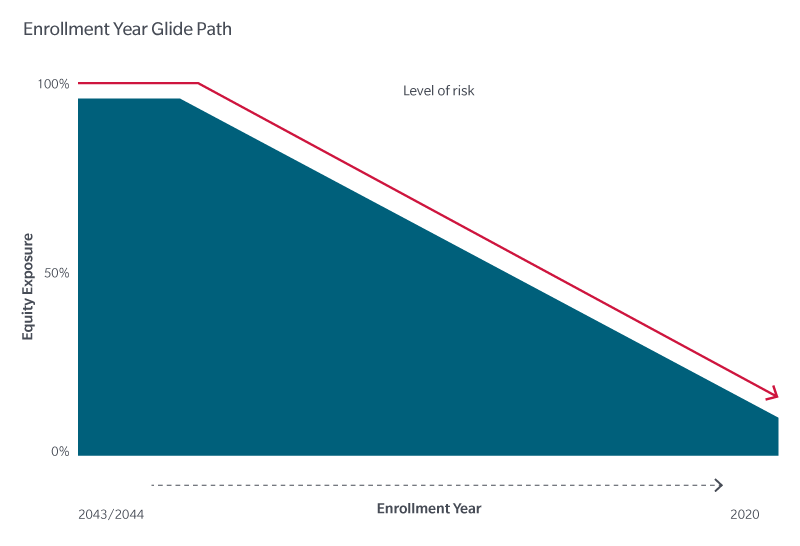

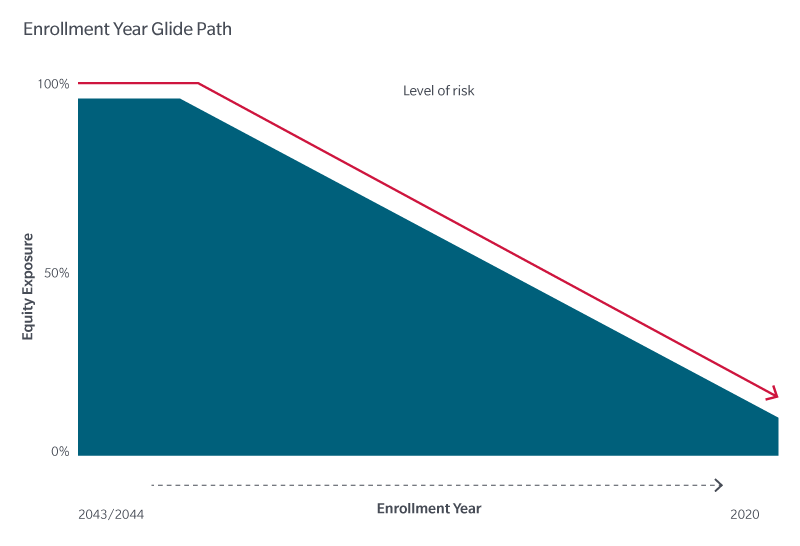

Enrollment Year Investment Option

Similar to target date funds used by retirement plans, enrollment year Investment options provide investors with the option to choose an investment option based on beneficiary’s expected college enrollment year or the date when money will be needed for tuition and other qualified education expenses. The investment's focus gradually shifts from seeking asset growth to capital preservation, automatically adjusting as the beneficiary moves closer to college age.The new enrollment year funds employ a “set it and forget it” approach, with target year options that eliminate the need for investors to exchange funds as they move through the age brackets. The plan offers 25 enrollment year funds, from MFS 529 Enrollment Year 2020 through MFS 529 Enrollment Year 2044.

Risk-Based Approach

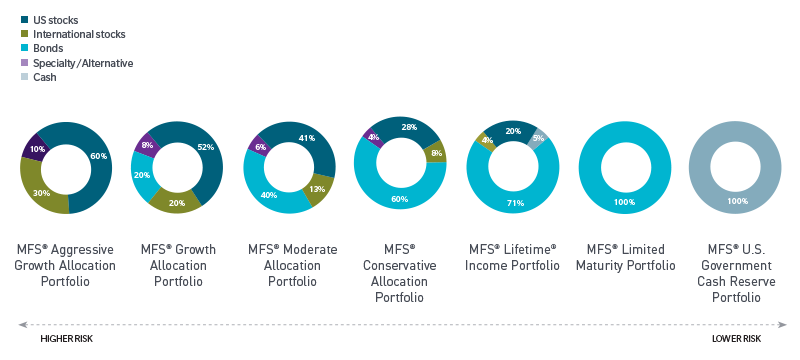

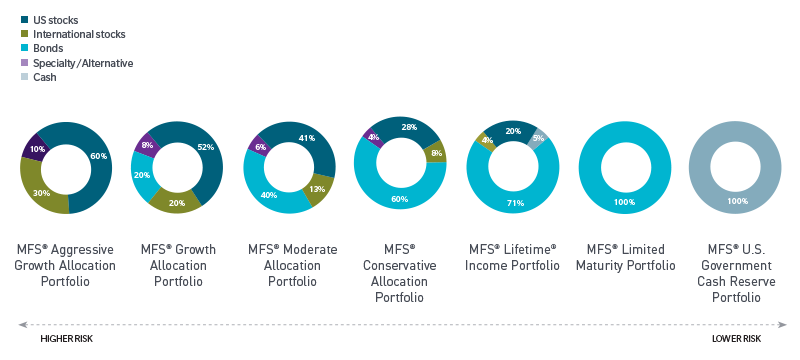

Risk-based portfolios generally have different allocations to stocks, bonds as well as specialty/alternative and cash options that align with a variety of investor goals and risk tolerances. These portfolios are invested in a diversified mix of MFS funds and are rebalanced periodically to maintain their objective and risk profile. Depending on the option selected, investments include US stocks, non-US stocks, bonds and specialty/alternatives such as commodities, real estate investment trusts (REITs), and derivatives and cash.

Keep in mind that no investment strategy, including allocate, diversify and rebalance, can guarantee a profit or protect against a loss. Also, all investments, including mutual funds, carry a certain amount of risk, including the possible loss of the principal amount invested.

The principal value of the portfolio options are not guaranteed at any time.

Each 529 portfolio invests in MFS mutual fund(s).

Performance of the MFS 529 Savings Plan’s Enrollment Year and Risk-Based portfolios depends on their underlying MFS funds. These funds may be subject to the volatility of global financial markets (domestic and international) and additional risks associated with investing in high- yield, small-cap, and foreign securities, as well as different fees and expense levels associated with investing in these funds. Asset allocation, diversification and rebalancing do not guarantee a profit or protect against loss.

Underlying Fund Allocations

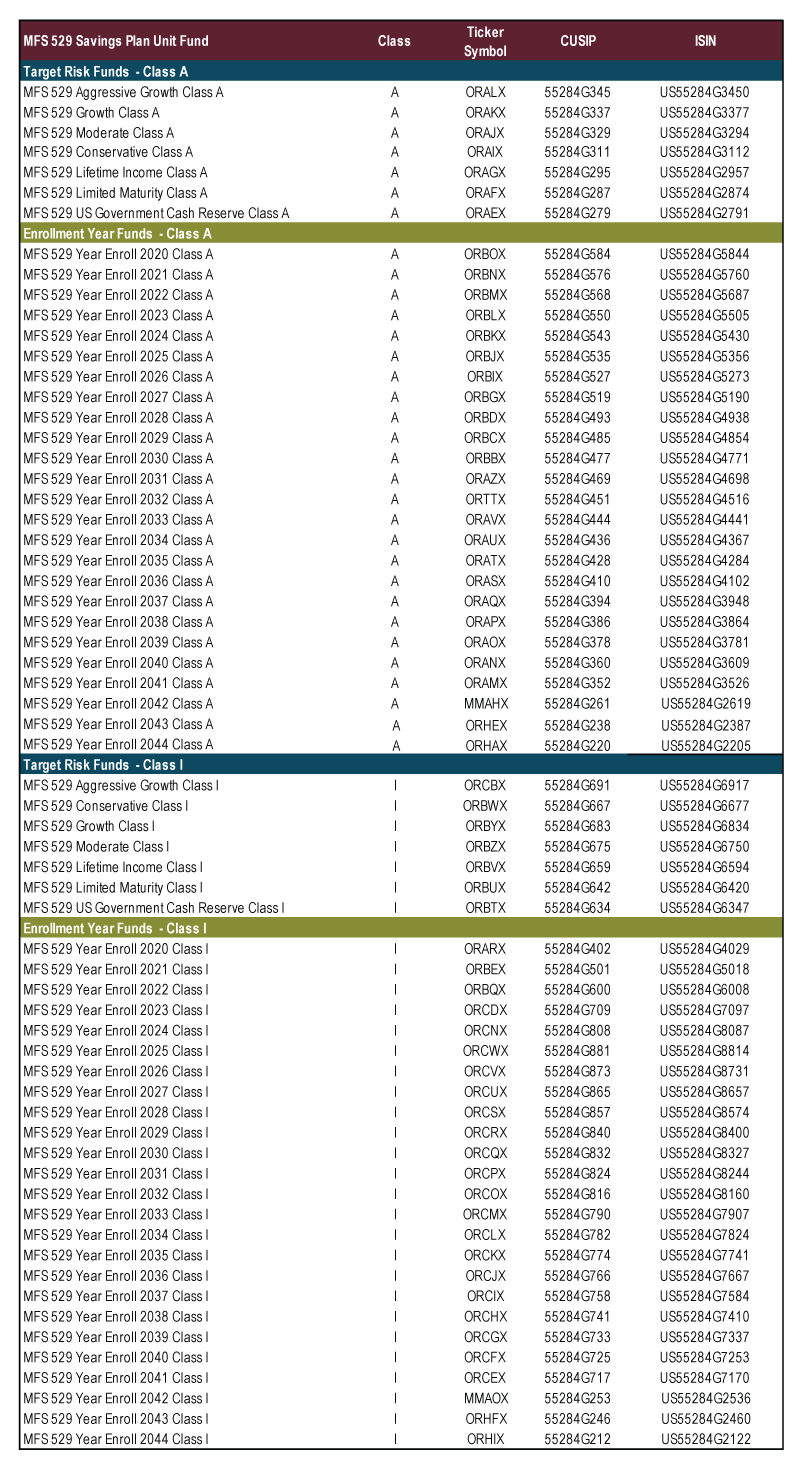

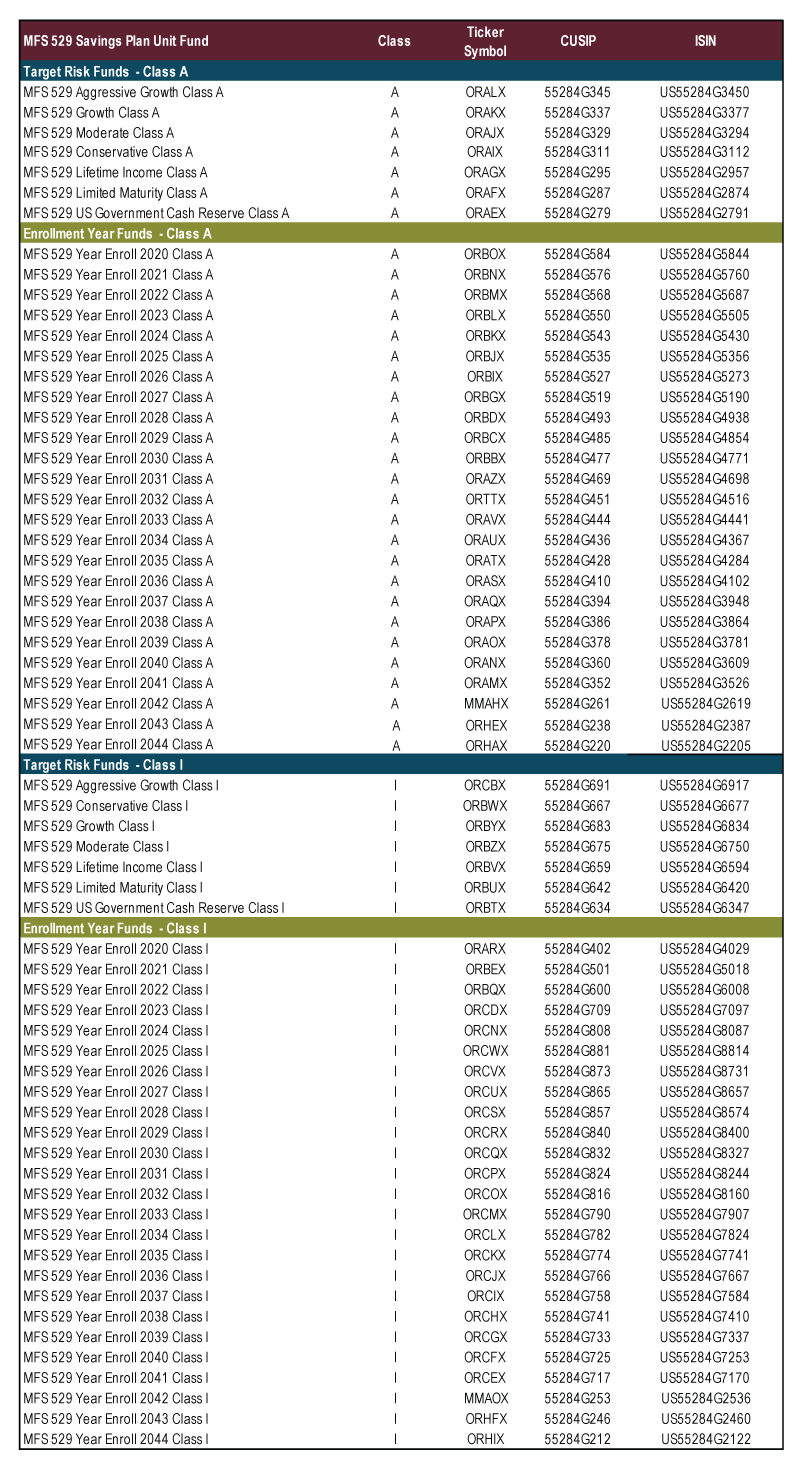

CUSIP/Ticker Summary

CUSIP/Ticker Symbol

Plan Pricing

Plan Pricing

Class A Units

Enrollment Year Portfolios: 2024-2044

(Implied Participant Ages 0-20)

Risk-Based Portfolios:

Aggressive Growth, Growth, Moderate, Conservative, Lifetime Income, Limited MaturityEnrollment Year Portfolios: 2020-2023

(Implied Participant Ages 21-24)

Risk-Based Portfolios:

US Government Cash ReservePURCHASE AMOUNT SALES CHARGE DEALER PAYMENT SALES CHARGE DEALER PAYMENT Less than $250,000 2.50% 2.00% None None $250,000 and above None .50% None None Class I Units are available without a sales charge to eligible investors. Please see the Participation Agreement and Disclosure Statement for an explanation.

-

-

Performance

-

Gifting Features & Tax Advantages

Gifting Features & Tax Advantages

An individual can contribute as much as $19,000 each year ($38,000 for married couples) without gift-tax consequences.

Under a special election, up to $95,000 ($190,000 for married couples) can be contributed at one time by accelerating five years’ worth of contributions (as gifts). This feature makes it an attractive estate planning tool for many. The account owner will not incur federal gift taxes as long as he/she does not make additional gifts to the same designated beneficiary for four years after the year in which the accelerated five-year gift has been made. In order to do this, the account owner must make an election on a federal gift tax return for the year of the contribution. However, if the account owner elected to treat the gifts as having been made over a five-year period and dies before the end of the five-year period, the portion of the contribution allocable to the remaining years in the five-year period would be includable in computing the account owner’s gross estate for federal estate tax purposes. Account owners should consult their tax advisors for more information regarding the gift and estate tax consequences of opening an account. Gift limits are current as of January 1, 2025, tax rules are subject to change.

Education savings programs come in many shapes and sizes today. That’s why the insight and guidance of a financial advisor or investment professional is so valuable. He or she will help you choose the right plan and then help you select the investment options that best fit your needs and tolerance for risk. Consult your tax professional for tax advice applicable to your particular circumstances.

The MFS 529 Savings Plan makes it easy to open and maintain a gift of education. For as little as $250 you can open an account, with no minimum for additional contributions. So it’s smart to let family and friends know about the account so they can consider investing in the child’s future too.

One of the key features of 529 savings plans is tax advantages.

Earnings are tax deferred and, if used for qualified education expenses are not subject to federal income tax. Withdrawals not used for qualified education expenses are subject to both income taxes and a 10% federal tax penalty on earnings. State taxes may also apply. State tax treatment may differ.

MFS 529 SAVINGS PLAN UGMA/UTMA Income Tax Treatment Withdrawals are federal tax free if used for qualified education expenses. For funds withdrawn for tuition for enrollment or attendance at an elementary or secondary public, private or religious school, only $10,000 per year per beneficiary will be free from federal tax. State taxes may differ Earnings are taxed at the beneficiary's rate Contribution Limits Up to $400,000 account balance per beneficiary None Income Limits No limits No limits Control of Assets Account Owner Custodian until child reaches majority; then the child Investment Flexibility You can move assets among investment options twice each calendar year or when you change beneficiaries You can move assets as often as you want, but each transfer usually is a taxable event Estate Planning Features Assets are transferred out of the owner’s estate. The owner retains control Assets are transferred out of the estate Uses Can be used for almost any accredited post-secondary school, as well as tuition at an elementary or secondary public, private or religious school No restrictions Ability to Change Beneficiaries Can be transferred to another member of the same family without penalty# Not permitted Penalties on Nonqualified Withdrawals Ordinary federal income taxes and a 10% IRS penalty on earnings. State taxes may also apply None State Tax Credit Yes, for Oregon taxpayers* No Annual Fee $25 annual fee, waived for residents of Oregon† Differs, depending upon funding vehicle * Oregon taxpayers may receive a state tax credit for contributions to accounts in the Network of up to $180 ($360 if filing jointly). The amount the taxpayer must contribute to get the full credit increases based on the taxpayer's income. The Oregon Department of Revenue will periodically adjust the amount of the credit for inflation. For additional state and local tax considerations, please refer to the Participant Agreement and Disclosure Statement.

† Other waivers may apply.

# However, there may be federal gift tax consequences if the new designated beneficiary is a member of a younger generation in the family than that of the previous designated beneficiary. The account owner should consult with their tax advisor regarding the potential applicability of gift tax or generation-skipping transfer tax as a result of a permissible transfer or change in the designated beneficiary.

-

Forms & Related Resources

Forms & Related Documents

Plan Participant Agreement & Disclosure Statement

Additional Resources

There's a lot to know when planning for college. Additional information on financial aid, college selection, and scholarships are available on the following websites.

- Compare the difference between the major types of education loans that are available at www.edvisors.com.

- Get help searching for the right college, scholarships and loans at www.collegexpress.com.

- Wondering if a Parent PLUS loan is right for your clients? learn more about these loans at www.edvisors.com.

- To get expert tips on financial aid, search for scholarships and download college applications, visit www.fastweb.com.

- Looking for a private student loan? Find potential lenders and loan options at www.edvisors.com.

- Compare 529 plans, read articles, calculate education costs, and more, go to www.savingforcollege.com.

- Learn more about finding the right school, testing, and paying for college at www.collegeboard.com.

The MFS 529 Savings Plan is a flexible education savings investing plan sponsored by the State of Oregon, acting by and through the Oregon 529 Savings Board and is part of the Oregon 529 Treasury Savings Network. Vestwell State Savings LLC is the Program Manager and record-keeper of the plan. The Program Manager may designate other firms to perform certain duties, including the Bank of New York Mellon as record-keeper of the plan. MFS Investment Management acts as the investment manager and MFS Fund Distributors, Inc., is the distributor. Units of the investment options of the MFS 529 Savings Plan accounts are considered municipal fund securities.

Depending on your state of residence and the state of residence of the beneficiary, an investment in the MFS 529 Savings Plan may not afford you or your beneficiary state tax benefits or other benefits only available for investments in such state's qualified tuition program. State benefits may include financial aid, scholarship funds and protection from creditors. State tax treatment may differ from the federal tax treatment. See a tax advisor to be sure you understand the tax issues related to a 529 plan. Withdrawals of earnings not used to pay for qualified education expenses are subject to an additional 10% federal tax penalty. State taxes may also apply.

MFS 529 Savings Plan Accounts are not deposits or obligations of, or insured or guaranteed by, the State of Oregon or any agency or instrumentality thereof, the United States government, the Program Manager, any financial institution, the Federal Deposit Insurance Corporation or any other federal or state governmental agency, entity or person. Investment returns are not guaranteed. Your account may lose value.

There is a $25 annual account fee associated with the MFS 529 Savings Plan. This fee is waived for accounts of Oregon residents and to the extent approved by the Board, subaccounts of Omnibus Accounts. Other waivers may apply. Investments in 529 plans involve investment risks. You should consider your needs, goals, and risk tolerance prior to investing.

Before investing in the MFS® 529 Savings Plan, consider the investment objectives, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, as well as a Participant Agreement and Disclosure Statement including an Expense Overview, contact your investment professional or view online at mfs.com. Read it carefully.

MFS does not provide legal, tax, or accounting advice or investment advice with respect to the decision to invest in the Plan or selection of investment option(s). Individuals should not use or rely upon the information provided herein without first consulting with their tax or legal or financial professionals about their particular circumstances. Any statement contained in this communication (or elsewhere on this web site) concerning U.S. tax matters was not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code. This communication was written to support the promotion or marketing of the transaction(s) or matter(s) addressed.

MFS Investment Management and its affiliates are not affiliated with Vestwell State Savings LLC or The Bank of New York Mellon.

MFS Fund Distributors, Inc., Member SIPC, Boston, MA

56477.3

-

Overview

-

Investment Options & Pricing

-

Performance

-

Gifting Features & Tax Advantages

-

Forms & Related Resources

Overview

The MFS 529 Savings Plan was designed to offer a wide range of investment choices, gifting and estate tax benefits, as well as quality service. And, of course, the investment management expertise of MFS Investment Management.

Investment Options & Pricing

-

Investment Options

-

Underlying Fund Allocations

-

CUSIP/Ticker Summary

-

Plan Pricing

Investment Options

Investment Options

An MFS 529 Savings Plan offers a variety of investment choices, as well as two investment paths.

Enrollment Year Investment Option

Similar to target date funds used by retirement plans, enrollment year Investment options provide investors with the option to choose an investment option based on beneficiary’s expected college enrollment year or the date when money will be needed for tuition and other qualified education expenses. The investment's focus gradually shifts from seeking asset growth to capital preservation, automatically adjusting as the beneficiary moves closer to college age.

The new enrollment year funds employ a “set it and forget it” approach, with target year options that eliminate the need for investors to exchange funds as they move through the age brackets. The plan offers 25 enrollment year funds, from MFS 529 Enrollment Year 2020 through MFS 529 Enrollment Year 2044.

Risk-Based Approach

Risk-based portfolios generally have different allocations to stocks, bonds as well as specialty/alternative and cash options that align with a variety of investor goals and risk tolerances. These portfolios are invested in a diversified mix of MFS funds and are rebalanced periodically to maintain their objective and risk profile. Depending on the option selected, investments include US stocks, non-US stocks, bonds and specialty/alternatives such as commodities, real estate investment trusts (REITs), and derivatives and cash.

Keep in mind that no investment strategy, including allocate, diversify and rebalance, can guarantee a profit or protect against a loss. Also, all investments, including mutual funds, carry a certain amount of risk, including the possible loss of the principal amount invested.

The principal value of the portfolio options are not guaranteed at any time.

Each 529 portfolio invests in MFS mutual fund(s).

Performance of the MFS 529 Savings Plan’s Enrollment Year and Risk-Based portfolios depends on their underlying MFS funds. These funds may be subject to the volatility of global financial markets (domestic and international) and additional risks associated with investing in high- yield, small-cap, and foreign securities, as well as different fees and expense levels associated with investing in these funds. Asset allocation, diversification and rebalancing do not guarantee a profit or protect against loss.

Underlying Fund Allocations

CUSIP/Ticker Summary

CUSIP/Ticker Symbol

Plan Pricing

Plan Pricing

Class A Units

| Enrollment Year Portfolios: 2024-2044 (Implied Participant Ages 0-20) Risk-Based Portfolios: Aggressive Growth, Growth, Moderate, Conservative, Lifetime Income, Limited Maturity |

Enrollment Year Portfolios: 2020-2023 (Implied Participant Ages 21-24) Risk-Based Portfolios: US Government Cash Reserve |

|||

| PURCHASE AMOUNT | SALES CHARGE | DEALER PAYMENT | SALES CHARGE | DEALER PAYMENT |

| Less than $250,000 | 2.50% | 2.00% | None | None |

| $250,000 and above | None | .50% | None | None |

Class I Units are available without a sales charge to eligible investors. Please see the Participation Agreement and Disclosure Statement for an explanation.

Gifting Features & Tax Advantages

An individual can contribute as much as $19,000 each year ($38,000 for married couples) without gift-tax consequences.

Under a special election, up to $95,000 ($190,000 for married couples) can be contributed at one time by accelerating five years’ worth of contributions (as gifts). This feature makes it an attractive estate planning tool for many. The account owner will not incur federal gift taxes as long as he/she does not make additional gifts to the same designated beneficiary for four years after the year in which the accelerated five-year gift has been made. In order to do this, the account owner must make an election on a federal gift tax return for the year of the contribution. However, if the account owner elected to treat the gifts as having been made over a five-year period and dies before the end of the five-year period, the portion of the contribution allocable to the remaining years in the five-year period would be includable in computing the account owner’s gross estate for federal estate tax purposes. Account owners should consult their tax advisors for more information regarding the gift and estate tax consequences of opening an account. Gift limits are current as of January 1, 2025, tax rules are subject to change.

Education savings programs come in many shapes and sizes today. That’s why the insight and guidance of a financial advisor or investment professional is so valuable. He or she will help you choose the right plan and then help you select the investment options that best fit your needs and tolerance for risk. Consult your tax professional for tax advice applicable to your particular circumstances.

The MFS 529 Savings Plan makes it easy to open and maintain a gift of education. For as little as $250 you can open an account, with no minimum for additional contributions. So it’s smart to let family and friends know about the account so they can consider investing in the child’s future too.

One of the key features of 529 savings plans is tax advantages.

Earnings are tax deferred and, if used for qualified education expenses are not subject to federal income tax. Withdrawals not used for qualified education expenses are subject to both income taxes and a 10% federal tax penalty on earnings. State taxes may also apply. State tax treatment may differ.

| MFS 529 SAVINGS PLAN | UGMA/UTMA | |

| Income Tax Treatment | Withdrawals are federal tax free if used for qualified education expenses. For funds withdrawn for tuition for enrollment or attendance at an elementary or secondary public, private or religious school, only $10,000 per year per beneficiary will be free from federal tax. State taxes may differ | Earnings are taxed at the beneficiary's rate |

| Contribution Limits | Up to $400,000 account balance per beneficiary | None |

| Income Limits | No limits | No limits |

| Control of Assets | Account Owner | Custodian until child reaches majority; then the child |

| Investment Flexibility | You can move assets among investment options twice each calendar year or when you change beneficiaries | You can move assets as often as you want, but each transfer usually is a taxable event |

| Estate Planning Features | Assets are transferred out of the owner’s estate. The owner retains control | Assets are transferred out of the estate |

| Uses | Can be used for almost any accredited post-secondary school, as well as tuition at an elementary or secondary public, private or religious school | No restrictions |

| Ability to Change Beneficiaries | Can be transferred to another member of the same family without penalty# | Not permitted |

| Penalties on Nonqualified Withdrawals | Ordinary federal income taxes and a 10% IRS penalty on earnings. State taxes may also apply | None |

| State Tax Credit | Yes, for Oregon taxpayers* | No |

| Annual Fee | $25 annual fee, waived for residents of Oregon† | Differs, depending upon funding vehicle |

* Oregon taxpayers may receive a state tax credit for contributions to accounts in the Network of up to $180 ($360 if filing jointly). The amount the taxpayer must contribute to get the full credit increases based on the taxpayer's income. The Oregon Department of Revenue will periodically adjust the amount of the credit for inflation. For additional state and local tax considerations, please refer to the Participant Agreement and Disclosure Statement.

† Other waivers may apply.

# However, there may be federal gift tax consequences if the new designated beneficiary is a member of a younger generation in the family than that of the previous designated beneficiary. The account owner should consult with their tax advisor regarding the potential applicability of gift tax or generation-skipping transfer tax as a result of a permissible transfer or change in the designated beneficiary.

Forms & Related Documents

Plan Participant Agreement & Disclosure Statement

Additional Resources

There's a lot to know when planning for college. Additional information on financial aid, college selection, and scholarships are available on the following websites.

- Compare the difference between the major types of education loans that are available at www.edvisors.com.

- Get help searching for the right college, scholarships and loans at www.collegexpress.com.

- Wondering if a Parent PLUS loan is right for your clients? learn more about these loans at www.edvisors.com.

- To get expert tips on financial aid, search for scholarships and download college applications, visit www.fastweb.com.

- Looking for a private student loan? Find potential lenders and loan options at www.edvisors.com.

- Compare 529 plans, read articles, calculate education costs, and more, go to www.savingforcollege.com.

- Learn more about finding the right school, testing, and paying for college at www.collegeboard.com.

The MFS 529 Savings Plan is a flexible education savings investing plan sponsored by the State of Oregon, acting by and through the Oregon 529 Savings Board and is part of the Oregon 529 Treasury Savings Network. Vestwell State Savings LLC is the Program Manager and record-keeper of the plan. The Program Manager may designate other firms to perform certain duties, including the Bank of New York Mellon as record-keeper of the plan. MFS Investment Management acts as the investment manager and MFS Fund Distributors, Inc., is the distributor. Units of the investment options of the MFS 529 Savings Plan accounts are considered municipal fund securities.

Depending on your state of residence and the state of residence of the beneficiary, an investment in the MFS 529 Savings Plan may not afford you or your beneficiary state tax benefits or other benefits only available for investments in such state's qualified tuition program. State benefits may include financial aid, scholarship funds and protection from creditors. State tax treatment may differ from the federal tax treatment. See a tax advisor to be sure you understand the tax issues related to a 529 plan. Withdrawals of earnings not used to pay for qualified education expenses are subject to an additional 10% federal tax penalty. State taxes may also apply.

MFS 529 Savings Plan Accounts are not deposits or obligations of, or insured or guaranteed by, the State of Oregon or any agency or instrumentality thereof, the United States government, the Program Manager, any financial institution, the Federal Deposit Insurance Corporation or any other federal or state governmental agency, entity or person. Investment returns are not guaranteed. Your account may lose value.

There is a $25 annual account fee associated with the MFS 529 Savings Plan. This fee is waived for accounts of Oregon residents and to the extent approved by the Board, subaccounts of Omnibus Accounts. Other waivers may apply. Investments in 529 plans involve investment risks. You should consider your needs, goals, and risk tolerance prior to investing.

Before investing in the MFS® 529 Savings Plan, consider the investment objectives, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, as well as a Participant Agreement and Disclosure Statement including an Expense Overview, contact your investment professional or view online at mfs.com. Read it carefully.

MFS does not provide legal, tax, or accounting advice or investment advice with respect to the decision to invest in the Plan or selection of investment option(s). Individuals should not use or rely upon the information provided herein without first consulting with their tax or legal or financial professionals about their particular circumstances. Any statement contained in this communication (or elsewhere on this web site) concerning U.S. tax matters was not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code. This communication was written to support the promotion or marketing of the transaction(s) or matter(s) addressed.

MFS Investment Management and its affiliates are not affiliated with Vestwell State Savings LLC or The Bank of New York Mellon.

MFS Fund Distributors, Inc., Member SIPC, Boston, MA

56477.3