A Century of Active Experience Built into Our Approach

-

Our philosophy

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

-

our fixed income story

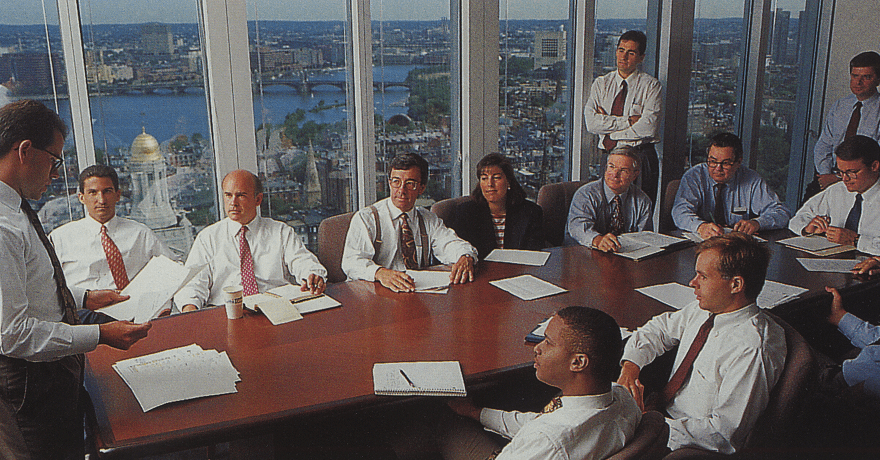

The Evolution of Fixed Income at MFS

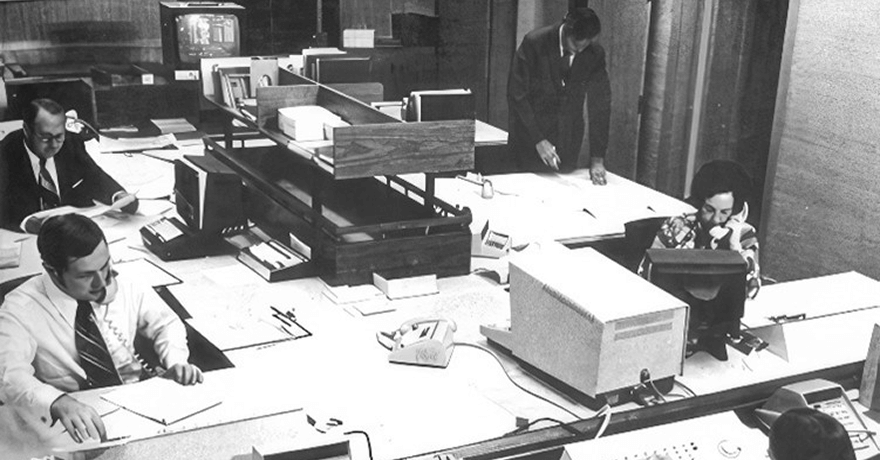

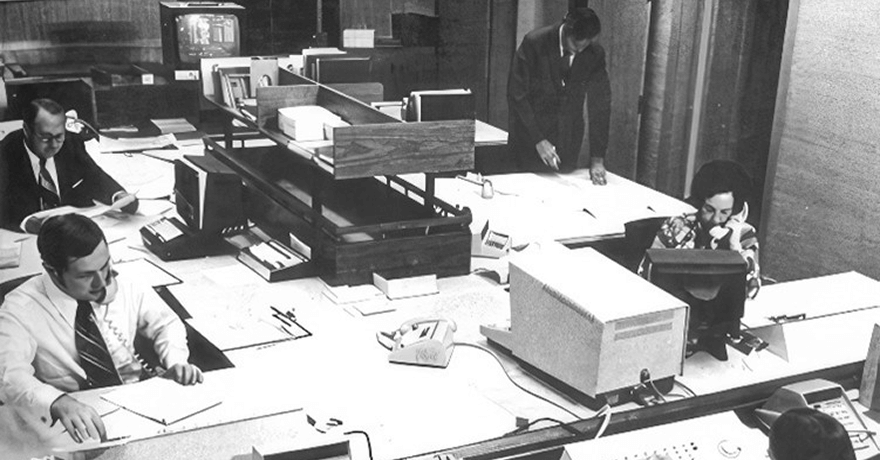

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

EVOLUTION OF MFS ACTIVE FIXED INCOMEScrollSwipe to explore

Bonds are typically

Bonds are typically

bought and heldwith investors collecting interest

until bond’s maturityInflation significantly

downgrades the value

of bondsand traditional buy-and-hold

strategiesMFS hires one of the

first portfolio managers

to trade bonds activelyusing credit and duration analysis,

helping transform bond investing

to better serve investorsMFS’ newly formed fixed income team includes one

of the first womenin the bond investing industry and launches the first balanced fund,

MFS® Total Return Fund.1

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Bond Fund, one of the earliest actively

managed bond portfolios.1

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds.

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds. MFS integrates

MFS integrates

fixed income, equity,

and quant teamscreating the unified global investment

platform we have today. Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”

Alex Mackey

Co-CIO, Fixed Income -

active solutions

Fixed Income Strategies

A pioneer of active investing and one of the first active bond managers, MFS offers strategies spanning the global bond market. Our strategies are designed to support institutional investors’ objectives including mitigating downside risk, diversifying fixed income allocations, enhancing returns and de-risking portfolios.

You May Be Interested In

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

The Evolution of Fixed Income at MFS

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

bought and held

until bond’s maturity

downgrades the value

of bonds

strategies

first portfolio managers

to trade bonds actively

helping transform bond investing

to better serve investors

of the first women

MFS® Total Return Fund.1

Bond Fund, one of the earliest actively

managed bond portfolios.1

fixed income, equity,

and quant teams

platform we have today.

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”Alex Mackey |

Fixed Income Strategies

A pioneer of active investing and one of the first active bond managers, MFS offers strategies spanning the global bond market. Our strategies are designed to support institutional investors’ objectives including mitigating downside risk, diversifying fixed income allocations, enhancing returns and de-risking portfolios.