Retirement Plan Investment Vehicles: The Growing Use of CITs

This paper discusses investment vehicle selection in DC plans with particular focus on the growing use of collective investment trusts (CITs) and highlights some of the important decisions plan sponsors should consider when implementing a CIT.

AUTHOR

Jeri Savage

Retirement Lead Strategist

This white paper discusses investment vehicle selection in defined contribution (DC) plans, with a particular focus on the growing use of collective investment trusts (CITs). It highlights some of the important issues plan sponsors should consider when implementing a CIT.

The logistics of investing in CITs are different from those of investing in mutual funds or separate accounts. The plan sponsor must understand the investment characteristics, the role the strategy will play in the plan’s overall portfolio and the anticipated value a CIT provides after fees. The plan sponsor must also decide how best to implement the CIT for the plan.

Below we outline the key characteristics plan sponsors should evaluate as they identify the “best fit” investment vehicle for their plans, with an emphasis on factors unique to CITs.

Comparing DC plan investment vehicles

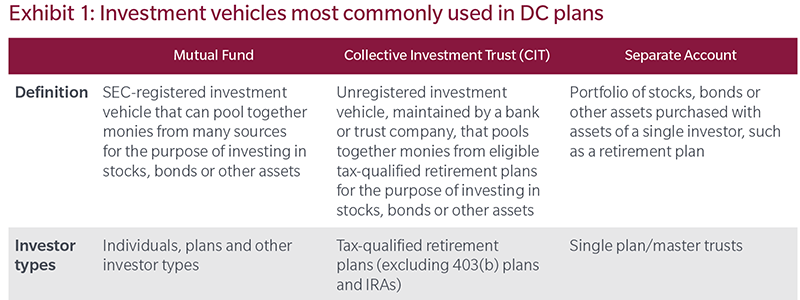

In the past, the asset size of a DC plan determined the investment vehicles available. Today, DC plans of varying sizes have choices across a variety of investment vehicles. The three most common investment vehicles used in DC plans are mutual funds, collective investment trusts (CITs) and separate accounts.1

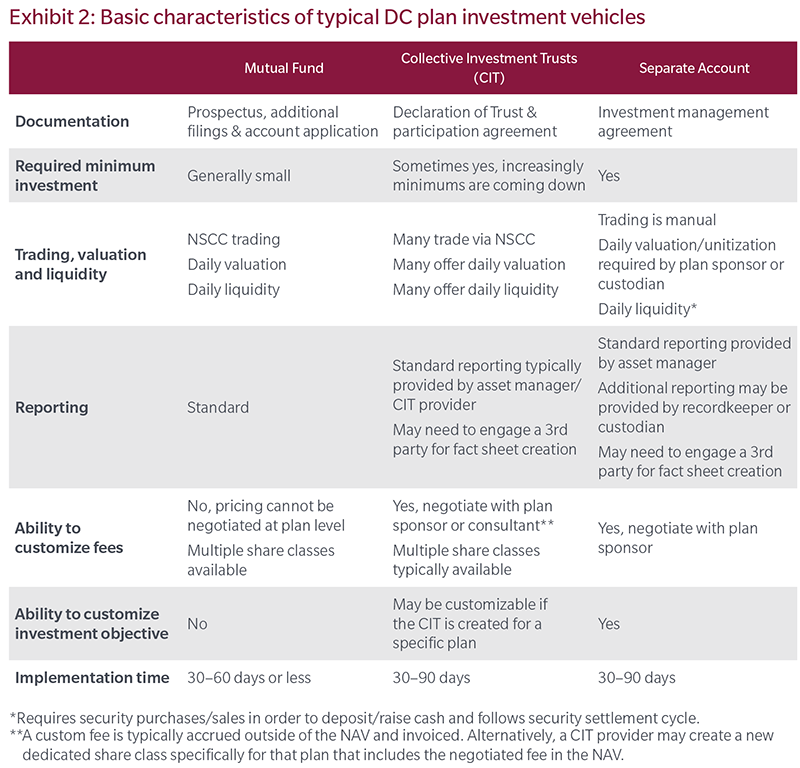

Upon the selection of an investment strategy, a plan sponsor needs to determine the most appropriate investment vehicle based on available options. Not all investment managers offer strategies in multiple vehicles, but when there is a choice, it is a good practice to explore vehicle options and document the due diligence process. Exhibit 2 contrasts some of the common characteristics of mutual funds, CITs and separate accounts.

Different vehicle, same monitoring responsibilities: Regardless of the investment vehicle, plan fiduciaries are responsible for the prudent selection and ongoing monitoring of the investment strategies offered on the plan menu. This can include, but is not limited to, regularly reviewing investment performance, understanding changes to people and process and reviewing fees. It is good practice for this review process to be documented and in accordance with the plan’s investment policy statement (IPS). |

“The investment vehicle decision, while important, should follow the plan sponsor’s selection of an investment strategy.”

Another CIT-specific factor for plan sponsors to consider is the percentage of assets that the plan’s investment would represent in the overall CIT. In addition to the percentage of assets, it is helpful to know how many other clients invest in the CIT. Some plan sponsors monitor these factors on an ongoing basis after investing in a CIT as they may not want the plan to represent more than a certain percentage of total assets or total clients invested in the CIT. While there is no rule of thumb for either metric, plan sponsors may have a preference based on their unique plan needs and circumstances.

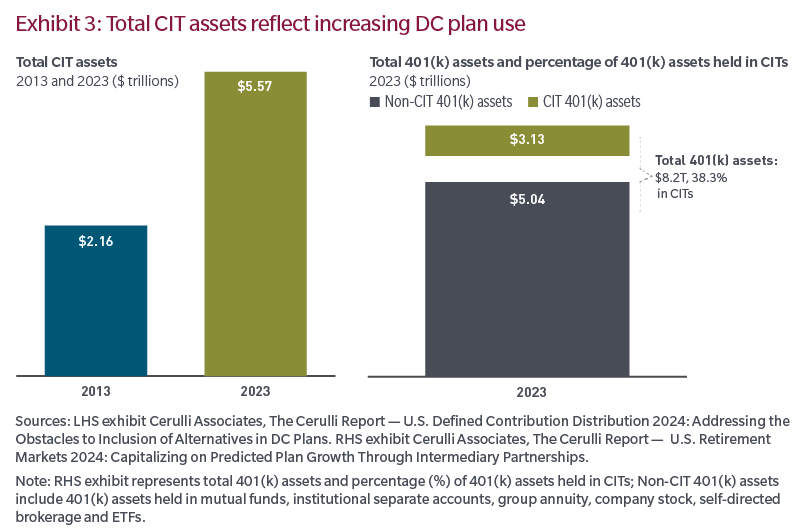

The use of CITs in DC plans is growing

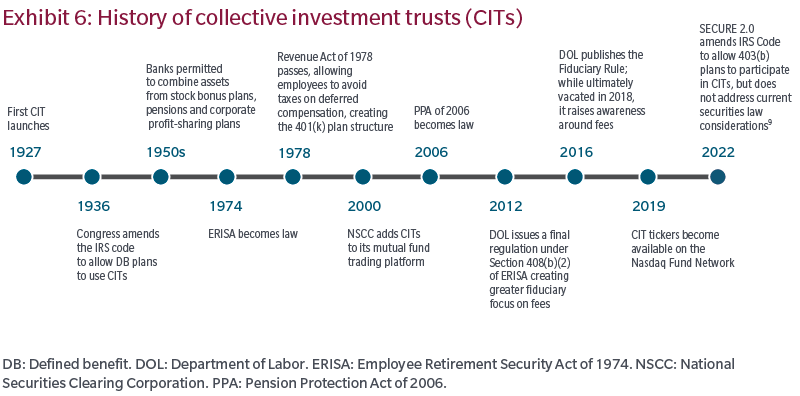

Total CIT assets have doubled over the past decade due to its increased adoption among 401(k) plans. In 2022, total CIT assets were $5.6 trillion, and comprised 38%, or about $3.1 trillion, of total 401(k) plan assets. CIT growth has come primarily at the expense of mutual funds, which saw their share of 401(k) assets decline to 40% of total 401(k) assets.2

Not for everyone: : CITs are available to DB and DC plans, excluding most 403(b), 457(b) and 457(f) plans. CITs are not permissible investment vehicles for individual retirement accounts (IRAs). Today, size matters less: Many CITs have share classes with zero or minimal required investments. This opens the door for small and midsize DC plans to explore whether CITs may be a good fit. CITs can also potentially provide pricing flexibility to respond to specific client, consultant or product situations. |

space

“Total CIT assets doubled in the past decade due to its increased adoption among DC plans.”

While stable value funds and passive investment strategies dominated early DC plan CIT adoption this is no longer the case. DC plan sponsors are now implementing CITs across a range of asset classes and investment styles, including default investments such as target date funds. Furthermore, recordkeeper platforms are more accommodating of CITs than they have been in the past.

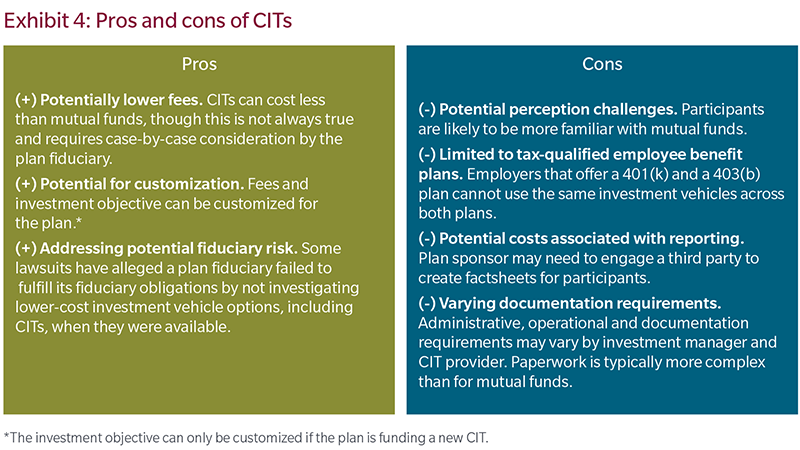

Determining whether a CIT is a good fit for the DC plan

As the retirement plan industry has evolved, so has the structure of investment vehicles used in DC plans. Today, plan sponsors have more investment vehicles and share classes from which to choose. This proliferation in choice can make it easier to find the most appropriate vehicle for the plan, albeit while introducing some complexity into the investment vehicle selection. CITs, which were once limited to the largest DC plans, are now available to a broader swath of plans due to decreasing required minimum investments. Furthermore, CITs are increasingly attractive to plan sponsors because of the potential fee advantages they may present compared to mutual funds.

Pros and cons of CITs

There are several decision points for plan sponsors to navigate when considering whether a CIT is a good fit. Below are some of the pros and cons of implementing a CIT in a DC plan.

Cheapest ≠ best fit: ERISA does not mandate that a plan fiduciary choose the lowest-cost option, whether it is an investment strategy or an investment vehicle. A good practice for plan sponsors is to conduct thorough due diligence on the types of investment vehicles that are available to the plan and to document the reasons for choosing a particular vehicle. No prospectus? While a CIT is not required to have a prospectus like a mutual fund, a CIT still has important governing documents. For example, the Declaration of Trust details investor eligibility, valuations, subscriptions and redemptions. The fund may have an offering memorandum that describes the objective and strategy, principal risks, fees/expenses, and other details. |

How CITs can offer fee advantages relative to a mutual fund

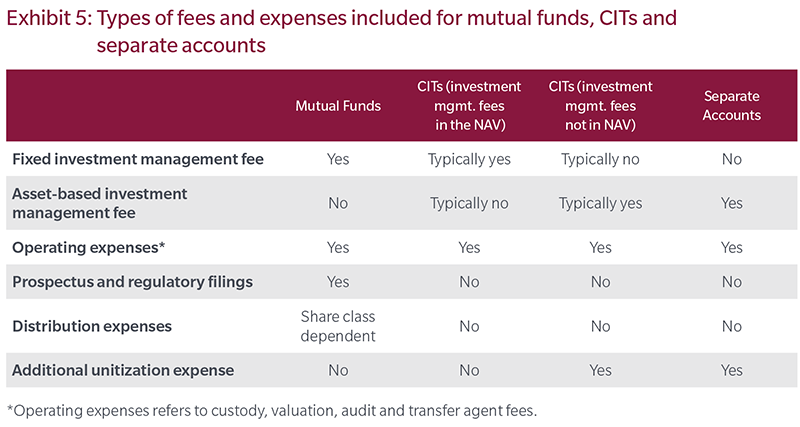

Investment vehicle selection can present an opportunity to reduce fees, and this potential for fee efficiencies is the primary force driving DC plan assets into CITs. In general, CITs have lower administrative, marketing and distribution costs than mutual funds, as reflected here:

- No Securities and Exchange Commission (SEC) reporting requirements

- No boards of directors and their related expense

- No retail share classes, which typically results in lower trading and transfer agent costs

- Simpler disclosure statements (e.g., no prospectus required)

The above characteristics contribute to a CIT’s lower cost structure relative to a mutual fund, which can provide savings for participants. Also, depending on how a share class structure is created within a CIT, plan sponsors can potentially further negotiate fees for the plan (see “Fee and expense structures” below).

“The potential for fee efficiencies is the primary force driving DC plan assets into CITs."

Implementation considerations

The logistics of investing in CITs are different from those of investing in mutual funds or separate accounts. The plan sponsor must understand the investment characteristics, the role the strategy will play in the plan’s overall portfolio and the anticipated value a CIT provides when the fees charged are factored in. The plan sponsor must also decide how best to implement the CIT for the plan.

We identify four key topics related to CIT implementation that merit careful consideration and further due diligence.

- Unitization — direct or unitized investment

- Fee and expense structures — investment management fee included or excluded from the NAV

- Operating procedures — trading processes and transacting in CITs

- Data availability and reporting — meeting plan and participant needs

The investment manager or CIT sponsor should be prepared to discuss the various features of its CIT and support the plan sponsor in thinking through the various decision points related to implementation. To facilitate this dialogue, we provide questions for plan sponsors to consider regarding each of these aspects of implementation.

What’s in a name? Increasingly, plan sponsors are revisiting the naming conventions of funds on the investment menu, also referred to as “white labeling.” Simplifying fund names to align with the fund’s purpose in a participant’s broader portfolio can help make investing for retirement more intuitive and less intimidating for participants, e.g., combining multiple geographic and style equity funds into a single “Plan ABC Growth Fund.” PEPs and CITs: A match made in heaven? Pooled Employer Plans (PEPs) allow unrelated employers to join a multiple-employer plan, which can help alleviate administrative burdens and create economies of scale to potentially reduce investment and other expenses. PEPs are likely to create new, large pools of assets that could generate more opportunity for CIT use. |

Unitization

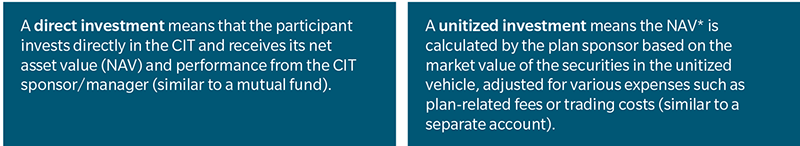

When considering a CIT, a first-order decision is how it will operate within the plan. An investment in a CIT can be direct or unitized.

*A fund’s net asset value (NAV) per share is the current value of all the fund’s assets, minus liabilities, divided by the total number of shares outstanding.

A unitized investment, while requiring a greater administrative commitment and expense, can offer the opportunity for a plan sponsor to further customize fees. Plan sponsors should weigh the additional operating cost and risk of striking a NAV, and calculating performance, against the potential benefit of being able to reduce fees.

In some cases, a CIT is implemented as a component of a “CIT of CITs” structure wherein several CIT investments are used as building blocks to create a single fund. Many consultants and plan sponsors are embracing this structure as it allows for packaging more than one investment strategy into a single white-labeled option. For example, custom target date funds often leverage a CIT of CITs structure.

Questions to consider regarding unitization

- Should the CIT be offered to our participants directly or blended with other investments (e.g., as part of a CIT of CITs)?

- What parties will be responsible for striking a NAV and calculating performance? What are the costs associated with this work?

- Would using CITs present an opportunity for white labeling?

Fees and expense structures

Because CITs are afforded some flexibility when it comes to fees, there are several fee-related nuances and decisions for plan sponsors to consider. Understanding how fees will be assessed and charged is one of the most important steps in determining whether CITs are appropriate for a particular plan. Specifically, plan sponsors should explore whether they want to include the investment management fee in the NAV calculation or not.

CITs are not always the most cost-effective vehicle. While CITs have garnered attention for being less expensive than mutual funds, they are not always the cheapest vehicle. For example, an R-6 mutual fund share class that is at scale may be more competitively priced than a CIT equivalent with fewer assets. Also, for the largest DC plans a separate account may present the most economical fee structure. A process for exploring these pricing differences is key for plan sponsors. |

“Understanding how fees will be assessed and charged is one of the most important steps in determining whether CITs are appropriate for a particular plan.”

A CIT may charge investors different investment management fees by offering multiple share classes. Differences across share classes typically relate to the amount of the fee charged and whether or not it is accrued in the CIT or invoiced outside of the CIT.3 Below, the two approaches to the accrual of investment management fees in CITs are described.

Investment management fees included in the NAV

- The share class accrues the management fee in the NAV calculation (similar to mutual funds).

- The CIT can accrue different management fees across the multiple classes of a portfolio while a mutual fund cannot.

- Management fees may be fixed or variable, based on the assets within the share class.

- Share classes with accrued management fees (i.e., included in the NAV) can be a more straightforward approach than that taken by share classes that exclude the investment management fee for DC plans because they simplify administration and participant disclosure.

Investment management fees excluded from the NAV

- The share class excludes investment management fees from the NAV (similar to a separate account fee structure). The share class includes other fees and expenses, such as custody, which are charged within the CIT.

- Accruing investment management fees outside of the NAV allows effective fees to be charged based on assets under management (e.g., fees typically follow a tiered fee schedule, X basis point fee on the first $10 million, Y basis point fee on the following $5 million, etc.).

- This approach can be attractive, particularly for large DC plans, as there is an opportunity to benefit from economies of scale and achieve a reduced effective fee.

- Because this fee fluctuates with assets it may, however, create additional administrative burdens for a DC plan’s communication efforts with participants (i.e., fee disclosure may need to be revisited each quarter to explain why the fee changed).4

Questions to consider regarding investment management fees

- Is it possible to customize fees for our plan?

- Is the fee structure consistent with the size of our plan?

- Is it easier for our plan to have investment management fees included or excluded from the NAV calculation?

- If the fee is accrued outside of the NAV and invoiced, how will it be paid?

- What is the best process for disclosing fees?

Operating procedures

In the past, CITs were valued on a periodic basis, since the DB plans using them did not require daily valuation and the CIT is not required to provide it. With the increase in DC plans using CITs, most are now valued daily and offer daily liquidity. Additionally, most CITs have a CUSIP and trade via the National Securities Clearing Corporation’s Defined Contribution Clearance and Settlement platform.5 While most CITs now offer a participant experience similar to that of a mutual fund, it is still important for the plan sponsor to understand from an operational perspective how the CIT will function within the plan.

Questions to consider regarding trading processes within a CIT

- Can our recordkeeper support the CIT on its platform?

- How will our plan trade with the CIT provider?

- When and how will our service providers receive NAVs?

- Is NSCC-trading an option for our plan?

- Are the operational details, such as trading and deadlines, documented?

Transacting in CITs and mitigating trading costs

In most commingled vehicles, including mutual funds and CITs, trading costs are capitalized with the cost or proceeds of a security and are borne by all investors through the NAV. CITs are available only to institutional investors; therefore, flows in or out of the CIT may represent a large percentage of the total CIT assets. As such, trading costs associated with these large flows may significantly impact the existing investors in the portfolio. To address this, most CIT providers implement a materiality threshold for large cash or in-kind transactions.6

There are three primary ways CIT providers can mitigate the potential impacts of large transactions on existing investors.

- Some CIT providers employ the use of a dedicated transition account maintained by the custodian bank of the CIT solely for the benefit of the transacting investor, e.g., a DC plan sponsor directing the flow.

- Plan sponsors may opt to use a transition manager to model the cash or securities, which can then be transacted as an assets-in-kind flow into the CIT. CITs receiving modeled securities from the transition manager generally incur no trading costs; therefore, no reimbursement is required.

- Transactions exceeding the stated materiality threshold may be required to pay an anti-dilution levy, essentially a transaction fee, which accounts for estimated transaction costs associated with executing security trades for the flow. The anti-dilution levy can be assessed in two ways: by reducing the subscription/redemption value purchased/redeemed or by assessing a payment to the transacting plan.7

Do participants want a ticker? While some participants like to have a ticker available, many do not have a strong opinion. Most CIT providers offer quarterly fact sheets that show the fund’s largest positions, sector exposures and performance. For plans that feel strongly about providing participants with a ticker, there are now 600+ CITs registered on the Nasdaq Fund Network.8 |

space

Questions to consider regarding transactions in a CIT

- Does the CIT provider have a detailed policy regarding anti-dilution?

- Does it make sense for our plan to transact in cash or securities?

- Is there a charge for trading costs, and how will it be handled by our plan?

- Should we hire a transition manager?

- What would be the impact on our participants?

Data availability and reporting

The lack of required reporting was once a significant hurdle preventing widespread DC plan CIT adoption; however, today most CIT sponsors make performance and holdings data available on a monthly basis, produce investment fact sheets and make investment data available for print materials and websites. The quarterly fact sheets produced for CITs are similar to what a participant would see for a mutual fund. Furthermore, the majority of fund managers provide data to third-party aggregators, such as Morningstar. In 2019, Nasdaq made CIT tickers available on the Nasdaq Fund Network to support CIT providers in making the vehicle more transparent for plan sponsors and their participants.

Questions to consider regarding CIT data availability and reporting

- What investment data are available?

- What investment data do our participants need?

- Do our participants require custom fact sheets, or can we use the manager’s format?

- What investment data are made available online?

- Will creating materials involve additional costs?

space

“A thorough investment-vehicle due diligence process can help plan sponsors arrive at the right vehicle for their plans.”

CITs are worth considering

As plan sponsors find more choices for how investment options are offered to participants — in terms of both investment vehicle and share classes — it is increasingly important to understand the pros and cons of what is available to the plan. Because CITs can offer lower fees relative to mutual fund equivalents, they are gaining in adoption and we believe this trend is likely to continue. That said, CITs will not be the right fit for every plan. A thorough due diligence process can help plan sponsors select the best vehicle for their plans.

Appendix: CITs 101

CITs are pooled, tax-exempt investment vehicles that commingle assets from eligible investors in one private investment portfolio with a specific strategy. They are sponsored and administered by a bank or trust company that also acts as the trustee.

CITs are available to DB and DC plans, excluding most 403(b), 457(b) and 457(f) plans. CITs are not currently permissible investment vehicles for individual retirement accounts (IRAs).

Unlike mutual funds, CITs are not registered under the Investment Company Act of 1940. Instead, the Office of the Comptroller of the Currency (OCC) or state banking regulators oversee them. The sponsoring trustee of a CIT is committed to acting in the best interest of unit holders because it is bound by the fiduciary standards under the Employee Retirement Income Security Act of 1974 (ERISA). While CITs may have once been characterized as less regulated than their mutual fund counterparts, this notion has largely been dispelled.

“CITs are regulated by the OCC or by state regulators of trust companies.”

Endnotes

1 DC plans in the micro market may use group annuities; however, this vehicle is limited to that segment of the market.

2 Source: Cerulli Associates, The Cerulli Report – “U.S. Retirement Markets 2024: Capitalizing on Predicted Plan Growth Through Intermediary Partnerships.”

3 Investment management fees are the fees related to portfolio management activities and do not include other operational costs.

4 Performance may be quoted both net of fees and gross fees for the investment regardless of how the actual fee is applied to the trust. This is standard practice for institutional investors.

5 DCC&S is a service package provided by the NSCC that facilitates automated processing and reporting for DC plans and their record keepers. Using this service allows a CIT to be traded, settled and reconciled like a mutual fund.

6 Reimbursement of trading costs to the CIT are important for a newly funded portfolio as initial transactions can be significant compared to the total assets.

7 For further information, please inquire about the MFS Heritage Company Anti-Dilution Implementation Policy.

8 Nasdaq Fund Network Driving Transparency for Collective Investment Trusts, presentation March 2021.

9 The SECURE 2.0 Act of 2022 was passed in December 2022. The Act amends the Internal Revenue Code to explicitly allow for 403(b) plans to participate in CITs; however, the legislation does not address current securities law considerations which prohibit such investments, so further action is necessary before this can be implemented. Legislation that would allow 403(b) plans to include CITs was reintroduced by the US House and Senate in February, 2025.