Back to Bonds: Why it may be time to make the move

Fixed Income public brochure that illustrates why the bond window of opportunity is now open for long-term investors.

Why Back to Bonds?

The Bond Window of Opportunity Is Open for Long-Term Investors

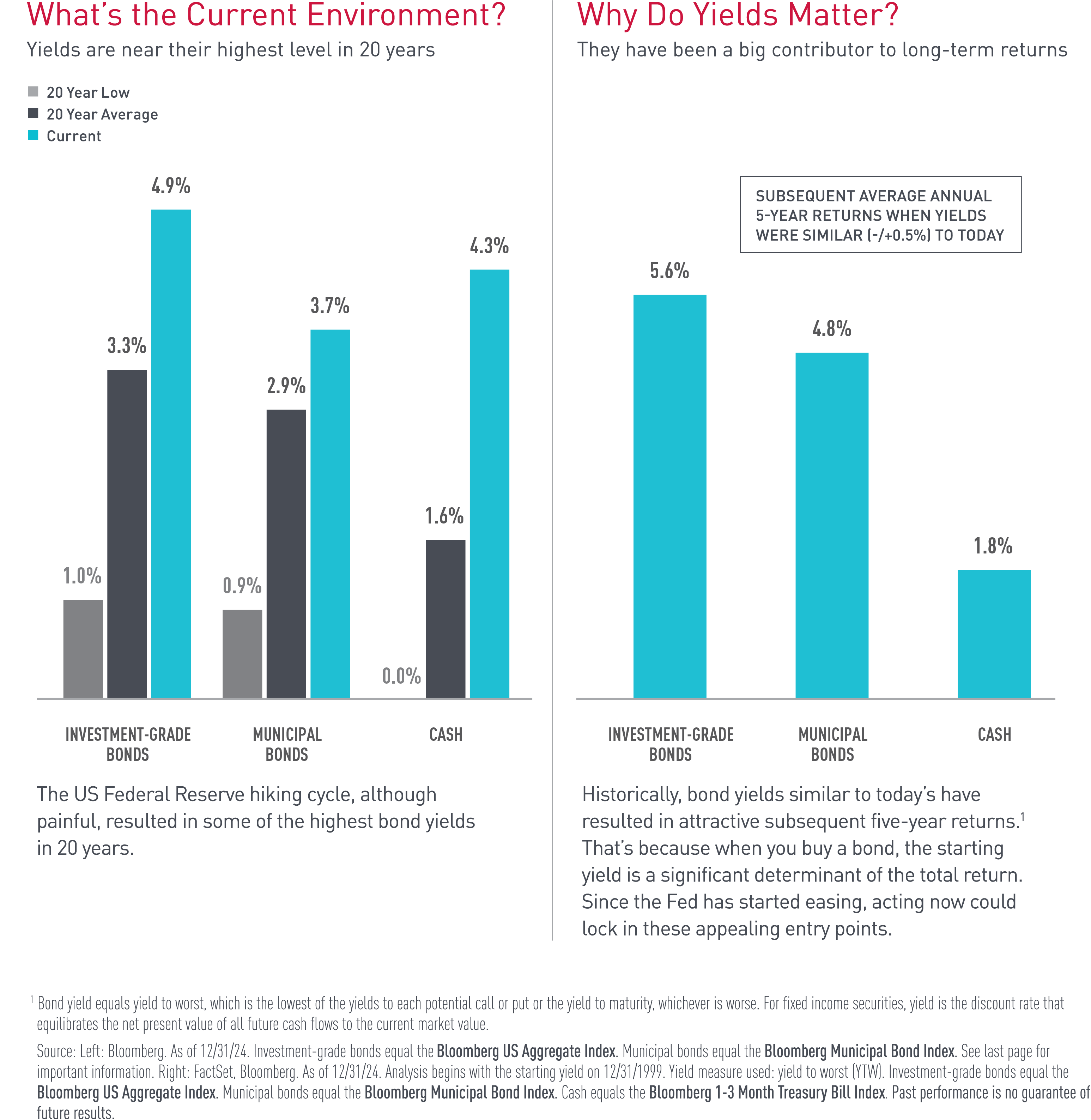

Without a doubt, cash was king in 2022 and into 2023. But markets have changed substantially. This year may be a pivotal point for investors sitting in cash, certificates of deposit, Treasuries or money market funds, one you don’t want to look back on and ask, “Why didn’t I move out of cash?” or “Why did I wait so long?” We believe now is the time to consider moving into bonds. Markets moved quickly at pivot points in the past, and opportunities to capitalize on changing dynamics disappeared quickly as well.

Which Offers More Potential?

Comparing a 5-Year Bond to a 1-Year CD

At first glance, yields on cash and bonds suggest a similar return potential. You might even think that a slightly higher return for bonds isn’t worth the risk. But it’s important to understand what those yields mean, the time period they represent and how it could impact returns. So let’s compare how a hypothetical five-year bond and a short-term cash equivalent vehicle such as a CD might perform over time.

Will 1-Year CDs Pay Off?

Exposing Reinvestment Risk

In the hypothetical example below, if the bond doesn’t default, the investor would receive a total return of 5% for five years. While the 1-year CD also has a 5% return in the first year, the investor would have to reinvest that money at the prevailing interest rate each subsequent year. Whether CD rates average 4%, 3% or 2% over the next five years is up for debate, but when the Fed has cut rates in the past, CD rates have fallen in tandem. Locking in attractive bond yields today will help you manage future reinvestment risk — such as the risk of having to reinvest proceeds in lower-yielding CDs.

Source: MFS research. This example is for illustrative purposes only and is not intended to predict the returns of any investment choices. Compounding is the process where money earned from investments such as interest or dividends is reinvested to earn more.

What to Consider?

Potential of Active Management Versus CDs

While it can be tough to give up the stability of money markets and CDs, that stability can come with a large opportunity cost over time. It may be time to consider bonds and active bond managers. Active managers strive to outperform the broad bond market indices, potentially providing the returns and income needed to pursue long-term goals. While certain bonds may offer higher current income, they are also associated with greater-than-average risk and the principal value and return will fluctuate with market conditions compared to CDs.

For more information or to learn more about MFS fixed income funds visit www.mfs.com or contact your investment professional.

In 1924, MFS launched the first US open-end mutual fund, opening the door to the markets for millions of everyday investors. Today, as a full-service global investment manager serving investment professionals, intermediaries and institutional clients, MFS still has a single purpose: to create long-term value for clients by allocating capital responsibly. That takes our powerful investment approach combining collective expertise, thoughtful risk management and long-term discipline. Supported by our culture of shared values and collaboration, our teams of diverse thinkers actively debate ideas and assess material risks to uncover what we believe are the best investment opportunities in the market.

*Municipal bonds are generally free from federal income tax. Treasuries are not taxed by states. Corporate bonds and CDs are taxed as ordinary income. Keep in mind that all investments, including mutual funds, carry a certain amount of risk including the possible loss of the principal amount invested.

Important Risk Information

Bond: Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio’s value may decline during rising rates. Portfolios that consist of debt instruments with longer durations are generally more sensitive to a rise in interest rates than those with shorter durations. At times, and particularly during periods of market turmoil, all or a large portion of segments of the market may not have an active trading market. As a result, it may be difficult to value these investments and it may not be possible to sell a particular investment or type of investment at any particular time or at an acceptable price. The price of an instrument trading at a negative interest rate responds to interest rate changes like other debt instruments; however, an instrument purchased at a negative interest rate is expected to produce a negative return if held to maturity. Municipal Bond: Investments in municipal instruments can be volatile and significantly affected by adverse tax or court rulings, legislative or political changes, market and economic conditions, issuer, industry-specific (including the credit quality of municipal insurers), and other conditions. Because many municipal instruments are issued to finance similar projects, conditions in certain industries can significantly affect the portfolio and the overall municipal market.

Definitions

Bond: When investors buy bonds, they are making loans to a company, government or institution. In return, the company promises to make regular interest payments at a set rate (coupon) and repay principle at a set date (the maturity). Certificate of deposit: A CD is a savings product that holds a fixed amount of money for a fixed period of time at a fixed interest rate. CDs are considered to be a safe investment options, but they do come with early withdrawal penalties. Yield to worst: For fixed income securities, yield is the discount rate that equilibrates the net present value of all future cash flows to the current market value. Average yield is the equivalent exposure weighted average yield to worst, which is typically the lowest of the yields to each potential call or put or the yield to maturity, whichever is worst.

Important information: The Bloomberg US Aggregate Index measures the US intermediate-term, investment-grade bond market, The Bloomberg Municipal Bond Index measures the US municipal bond market. Municipal Bonds: The Bloomberg US Municipal Bond Index, which measures US municipal bond market. US Cash: The Bloomberg 1-3 Month Treasury Bill Index, which measures US Treasury bills with a maturity of between 1 and 3 months.