Future trends should likely benefit a broader range of companies

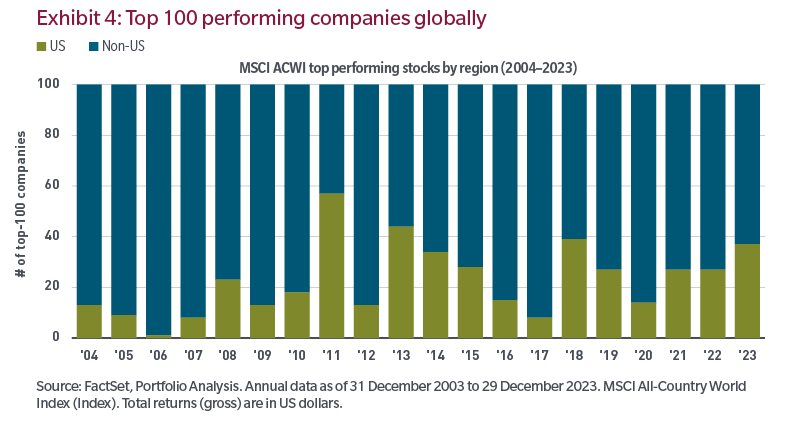

In addition to the parallels between today’s market environment and that of the early 2000s, perhaps more importantly, while technology and artificial intelligence will be an important part of our daily lives, we believe future trends will likely benefit a wider cohort of sectors and industries outside of just the technology-centric US companies of the past decade. Trends such as increased capex spending (versus opex only), spending to upgrade infrastructure, energy and the energy transition, defense and national security, as well as the reshoring and the localization of supply chains, just to name a few. And while many US companies stand to benefit from these trends, many more international companies stand to benefit as well. And while the US dominates the technology landscape globally, it would be naïve to assume that all the best companies in the world across a wide subset of sectors and industries reside in a single region or country.

Conclusion

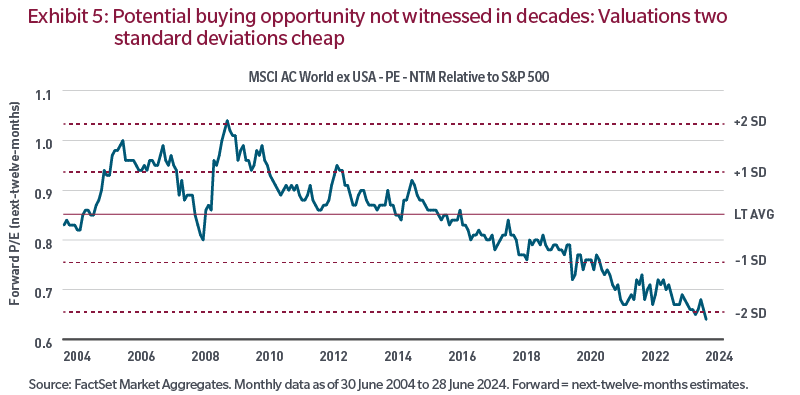

So just to bring things full-circle, I think we can all agree that over the next decade, whether it's monetary or fiscal policy, inflation or interest rates, or areas where future investments are likely to be made, all point to a landscape vastly different from the past decade and one where market leadership should expand across a wider subset of sectors and industries (versus just mega-cap tech) as well as countries and regions (both US and international). Additionally, in a world of higher interest rates and higher inflation, what you pay for the companies you own (i.e., valuation) and the quality of businesses you own will matter greatly.

Finally, and perhaps most importantly, the long-standing benefits of diversification, in what could prove to be a more difficult environment for risk assets versus the prior decade where quantitative easing and access to “free” capital was abundant, could potentially help investors meet their long-term investment goals as we enter this new and much different cycle versus the last. Starting points matter.

The views expressed are those of the author and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed. Past performance is no guarantee of future results.

“Standard & Poor’s®” and S&P “S&P®” are registered trademarks of Standard & Poor's Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC and has been licensed for use by MFS. MFS’s Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Frank Russell Company (“Russell”) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.