International Large Cap Value: The Forgotten Asset Class

Investors seeking to capture the benefits of diversification may be well served by an allocation to international large cap value given its sector composition and the low correlation of the asset class to US equity markets.

Authors

Steven R. Gorham, CFA

Portfolio Manager

David S. Shindler

Portfolio Manager

Nicholas J. Paul, CFA

Institutional Portfolio Manager

Key Takeaways

- Investor allocation to the international value asset class is at historically low levels, driven largely by an underallocation to non-US equities and intensified by ongoing concentration risk in US benchmarks.

- While US equities, most notably technology and growth stocks, have been in favor for well over a decade, history has shown that market leadership alternates between US and non-US stocks. Similarly, sometimes growth predominates, sometimes value, and there may in fact currently be a shift underway in international markets as international value has strongly outperformed international growth since the onset of interest rate hikes in early 2022 (Exhibit 1).

- Today’s macro landscape (higher inflation, higher interest rates, peak US dollar) and the relative valuation spread between US and international value stocks, coupled with the concentration risk in US indices, is reminiscent of the last period of sustained outperformance by the international value asset class.

- Investors looking to capture the benefits of diversification would be well served by an allocation to international large cap value given its sector composition and the low correlation of the asset class with US equity markets.

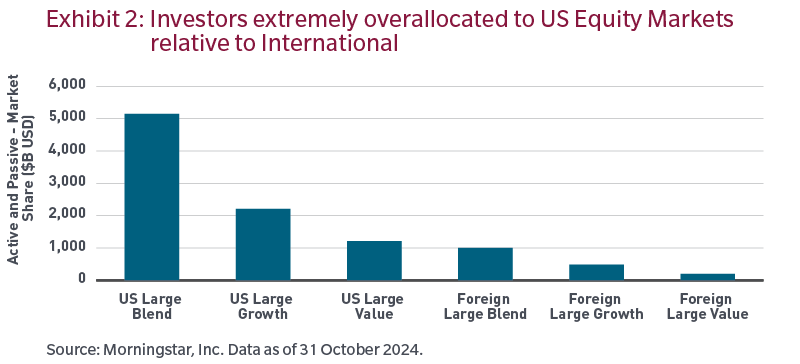

For well over a decade, a backdrop of declining interest rates and inflation expectations led investors to favor long-duration growth equities above all, dismissing the long-term benefits of diversification. With its technology-heavy orientation, the US market, using the S&P 500 Index as a proxy, generated an annualized return of 14.2% over the past 15 years through November 2024. The S&P 500 technology sector, which makes up 30% of the S&P 500 Index today, generated an annualized 20.2%. On the other hand, the MSCI EAFE Value Index, with its meaningful weights to out-of-favor areas of the market such as banks, metals and mining companies, and major oil companies, returned a paltry 4.5%. Not surprisingly, over this period we witnessed a surge in allocations to the growth-centric US market, leaving international asset classes in the dust, in particular the international large-cap value asset class (Exhibit 2).

Given the euphoria surrounding US equities, and technology stocks in particular, investors appear to have lost sight of the fact that there have been several extended periods of time during which international value stocks were in favor. At the outset of one of these time periods, the US dollar had appreciated by 40%, the S&P 500 had outperformed the EAFE Value Index by 7.2% annualized over the ten years prior, and the US equity market had become heavily concentrated in high-flying technology stocks. This was also a period where the 10-year treasury rate stood at 5.25% and world inflation at 3.4% which is more closely aligned with today’s reality vs. a world of zero inflation and zero interest rates for the decade following the global financial crisis. From a valuation standpoint, US equities were trading at a 24x NTM (next twelve month) valuation following a period of massive multiple expansion in a highly concentrated, tech-heavy, US market. Sounds familiar, right? No, we’re not referring to today, but rather to January of 2001. We all know what happened next, as this was the backdrop in the lead up to the dot-com bubble in the United States.

As of November 30, 2024, the US dollar has appreciated by 36% and the S&P 500 has outperformed EAFE Value by 9.7% annualized, as noted previously, over the past 15 years. The ten-year treasury sits at 4.2%, global inflation stands at 5.7% and the US market trades at 22x NTM earnings.* Further, it has been 20 years since the end of the last “AI winter,” and investors have now hung their hats on Large Language Models, a form of AI that has evolved into something nearly invaluable. That said, it is important to note that the mega-cap technology companies of today benefiting from investor exuberance around Generative AI are in most cases high-quality businesses and not comparable to the Pets.com or the eToys of the dot-com era. However, if earnings expectations for these concentrated areas of the market don’t live up to the lofty expectations embedded in their stock prices, and if multiples de-rate, the relative value opportunity for international stocks could be tremendous.

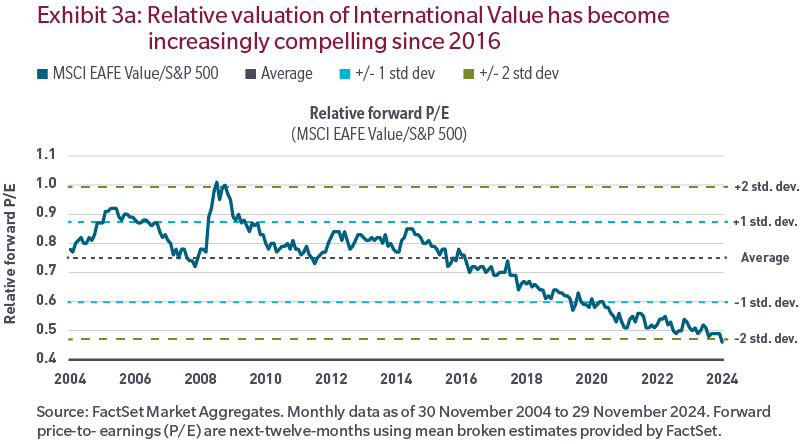

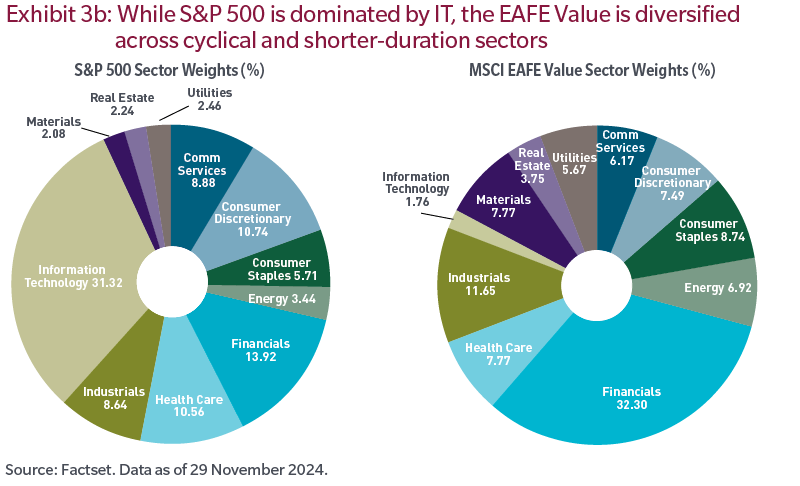

With that as the backdrop, what happened after the dot-com bubble is where we want to focus, as it will be the environment over the next ten years, not the last ten, that will drive investor returns. Over the 2000s business cycle, from March of 2001 through December 2007, the MSCI EAFE Value Index generated an annualized return of 10.9%. This was nearly three times the return of the S&P 500, which generated a return of 4.1%, with its technology sector generating a return of 0.35% over that same period. While the 31% drop of the S&P 500’s price-to-earnings ratio over this period was a large driver of poor US market returns, this is not what drove the international value market’s nearly 11% annualized return as it was driven entirely by earnings and dividends. In this context, it’s important to set the stage by comparing the market structure of the S&P 500 and the MSCI EAFE Value Index, as the two could not be more different. Perhaps the most notable difference — besides valuations now trading over two standard deviations “cheap” relative to the S&P 500 — is the EAFE Value Index, through exposure to cyclical and shorter-duration sectors such as financials, materials, industrials and energy, presents a much more diversified universe when compared to the tech-laden S&P 500 (Exhibits 3a and 3b). This is important in that, while technology remains a vibrant investment opportunity, we believe a much broader subset of sectors and industries appear well positioned to benefit from future earnings trends.

Earnings trends should benefit many

While the parallels between today’s market environment and that of the early 2000s (inflation, interest rates, relative valuation, concentration risk) are undeniable, perhaps more importantly, while technology and artificial intelligence will be an important part of our daily lives, we believe future investment trends will likely benefit a wider cohort of sectors and industries outside of just the technology-centric US companies of the past decade and the long-standing benefits of diversification will play an increasingly important part of client portfolios going forward.

These trends are likely to include increased capex spending (versus just technology-focused opex spending), spending to upgrade infrastructure, energy and the energy transition, defense and national security, as well as the reshoring and the localization of supply chains. And although many US companies stand to benefit from these trends, so do many international companies. And while the US dominates the technology landscape globally, it would be naïve to assume that all the best companies in the world across a wide subset of sectors and industries reside in a single region or country. Further, should elevated inflation hang around longer than expected, banks could become beneficiaries of higher rates as long as the economy doesn’t dip into a protracted recession. This is particularly true for international banks, since this unloved area of the market, which has dealt with stringent regulations and depressed net interest income since the sovereign banking crisis, is now dramatically de-risked and de-levered, consolidated and trading at attractive valuations — below book in many cases.

Diversification

While the connections we’ve made above between the lead-up to the 2000s cycle and today are important, we shouldn’t lose sight of the big picture; the long-term benefits of diversification. The most recent stretch of rolling 5-year US outperformance versus EAFE Value is the longest in the past 40 years. In fact, recent level of US relative outperformance vs. the broader international market has never been witnessed in history in terms of magnitude, which to us appears extremely stretched (to say the least) at today’s levels (Exhibit 4). At some point, as it always has in the past, its likely this relative performance leadership will reverse course, and investors will stand to benefit from the virtues of diversification.

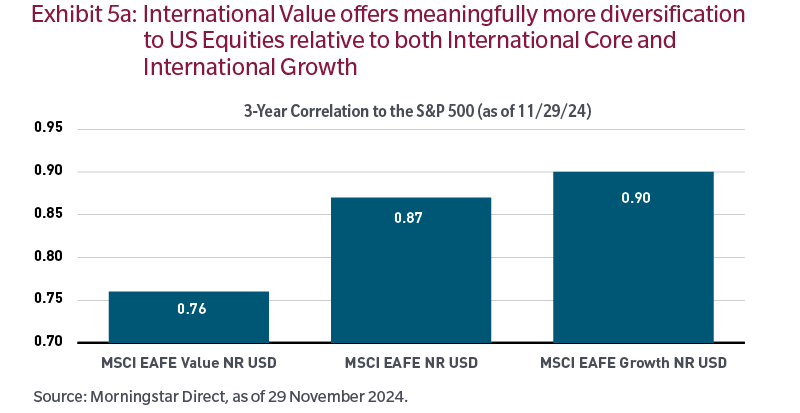

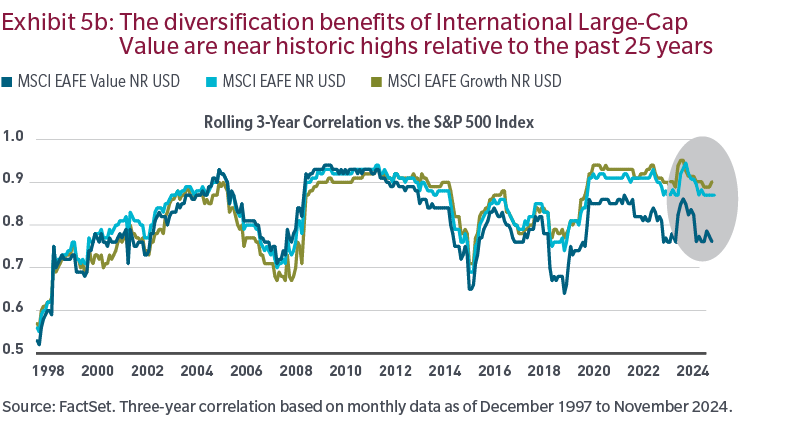

For long-term investors an allocation to the international value asset class can be a great diversifier to US exposure in an equity portfolio. While the historical benefits of diversification are well known among the investing community, not only does the international value asset class offer more diversification today for US investors, even when compared to both the international core and international growth asset classes, that level of diversification, when looked at through the lens of correlations, is at or near the widest levels we’ve witnessed historically (Exhibits 5a and 5b).

Conclusion

While no two periods are identical, there are several similarities between today and the eight-year period that began in the early eighties, when international value stocks strongly outperformed their US counterparts. Whether looking at inflation or interest rates, the value of the US dollar, valuation differential or simply the heightened concentration risk in US indices, the similarities are striking. Perhaps more importantly, coming out of a world of zero inflation and zero interest rates where diversification proved a headwind for performance, the outsized diversification benefits of an allocation to the international value asset class, in our opinion, could prove valuable to investors over the years to come.

Important Risk Considerations:

Investments in certain markets can involve greater risk and volatility because of adverse market, currency, economic, industry, political, regulatory, geopolitical, or other conditions. Stock markets and investments in individual stocks are volatile and can decline significantly in response to, or investor perception of, issuer, market, economic, industry, political, regulatory, geopolitical and other conditions.

“Standard & Poor’s®“ and S&P “S&P®“ are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’s Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.