Discover how the MFS Blended Research® strategies leverage the strengths of both fundamental and quantitative research to create a unique and powerful investment approach. Learn why this dual approach provides a more holistic view of the investable universe, balances short-term and long-term perspectives, and enhances portfolio decision-making.

Market Insights

Quarterly Fixed Income Webcast

Wednesday, February 18, 2026

11:00 A.M. EST

Find out how MFS Co-CIO of Fixed Income Pilar Gómez-Bravo is approaching today’s complex and fast-evolving market environment.

Strategist’s Corner

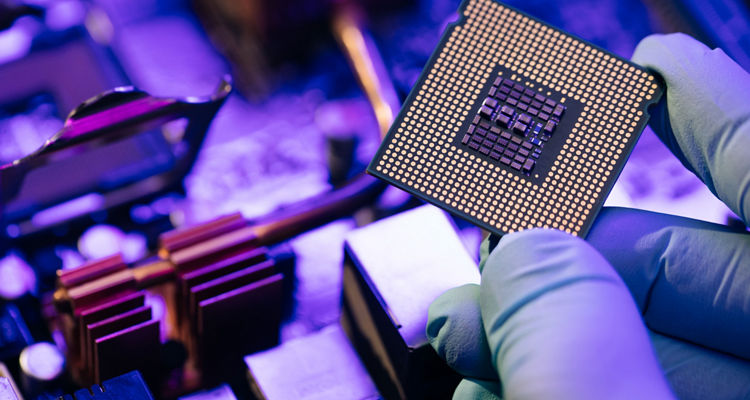

Memory is the New Oil

Week in Review

Feb 27: AI Job Loss Concerns Grow

Investment Insight

Portfolio Perspectives Q4 2025

In today's fast moving markets, our actionable insights can help you stay one step ahead

Get Active 360o insights direct to your inbox.